If you are interested in finding out more about us and the services we offer, please contact us.

Tax Compliance

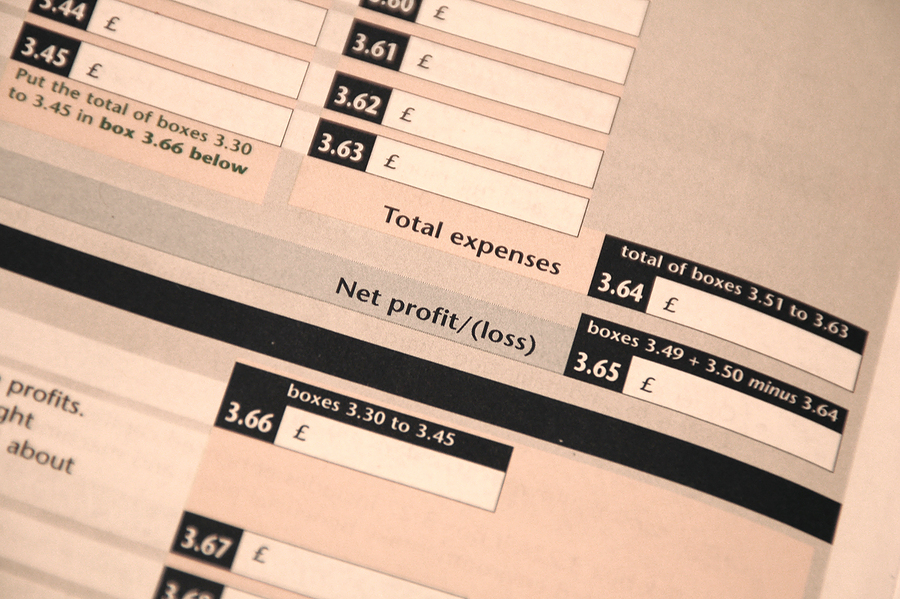

We deal with all aspects of UK tax compliance.

- Tax returns: Preparing all types of UK self-assessment tax returns and liaising with HMRC on your behalf.

- Preparing corporate, partnership, trust and estate tax returns

- Non-residents: preparing returns for non-residents, including non-resident landlords, non-resident CGT, ATED, etc.

- Guidance: Explaining in simple terms the complex rules and legislation that form the basis of the self-assessment system.

- Advice on the best use of available tax reliefs and allowances.

- Calculating your tax liabilities and notifying you when payments are due.

- Dealing with any HMRC enquiries and investigations arising.