Tag: tax avoidance

The myth of the long-term tax strategy

The myth of the long term tax strategy I am often asked by accountants to help advise their clients on long-term tax strategy. I’ll be honest – this gives me a problem. Mythical beast And it’s because the long-term tax strategy is something of a mythical beast – or at […]

Read More

Hopes dashed for appellants in De Silva case

Hopes dashed for appellants in De Silva case The Supreme Court yesterday (15 November) handed down its judgement in the case of R (on the application of De Silva and another) v Commissioners for Her Majesty’s Revenue and Customs. The appellants in the De Silva case were limited partners in […]

Read More

The General Anti-Abuse Rule (GAAR): What’s the point?

The General Anti-Abuse Rule (“GAAR”) The General Anti-Abuse Rule (“GAAR”) first came into effect in July 2013 on the passing into law of that year’s Finance Act, introduced by George Osborne, the then Chancellor in the Coalition Government. Yet it was 4 years later when the GAAR panel issued its […]

Read More

Derry v HMRC: Failure to make correct enquiries prevents HMRC from collecting tax in tax avoidance case

Derry v HMRC The Court of Appeal handed down its judgement in the case of R on the application of Derry v HMRC on 20 June. It is a case that could be significant for individuals who have participated in marketed tax arrangements and have made claims to carry back […]

Read More

Dave Hartnett, Former HMRC Permanent Secretary, criticised for flouting taxpayer confidentiality

The Supreme Court has today (19 October 2016) issued a judgement criticising the conduct of Dave Hartnett, the former Permanent Secretary in charge of Her Majesty’s Revenue and Customs (HMRC), for remarks he made about Patrick McKenna, founder of the Ingenious Media Group, in an interview in The Times in […]

Read More

Some tax avoidance schemes do work

Some tax avoidance schemes do work… “Some tax avoidance schemes do work. They avoid tax by adopting a legitimate, justifiable and commercially sensible structure to achieve a result which could be achieved by other legitimate and justifiable means. Where, however, that structure is artificial or has no purpose other than […]

Read More

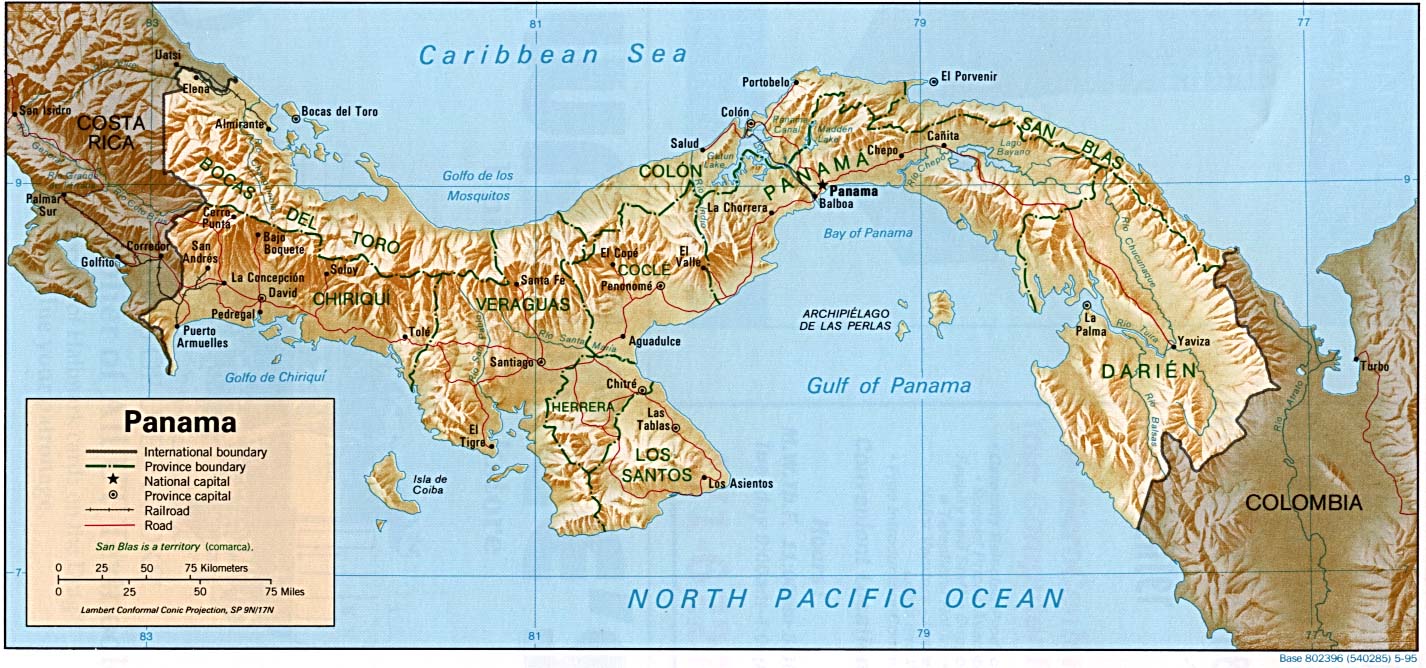

David Cameron and Tax Avoidance

David Cameron and tax avoidance A week after the Panama Papers first surfaced, the Prime Minister, David Cameron, is facing calls for his resignation. In the public imagination, David Cameron and tax avoidance are now inextricably linked and since his Government has loudly castigated such activity as morally repugnant, accusations […]

Read More

Mossack Fonseca and the journalists

Mossack Fonseca and the journalists Armed robbers with gloved hands bundle gold bars into open-zippered holdalls. An innocent security guard is beaten up by thugs and doused with petrol. Hang on, it’s before the watershed – should they be broadcasting scary scenes from gangster movies before the kids are in […]

Read More

Anti-avoidance: the UK's tax legislation and EU freedoms

Anti-avoidance: the UK’s tax legislation and EU freedoms For many years now, there have been serious doubts among a number of tax advisers, myself included, about the compatibility of much of the UK’s anti-avoidance tax legislation and EU law. I remember having a conversation about 10 years ago with a […]

Read More