Author: John Kavanagh

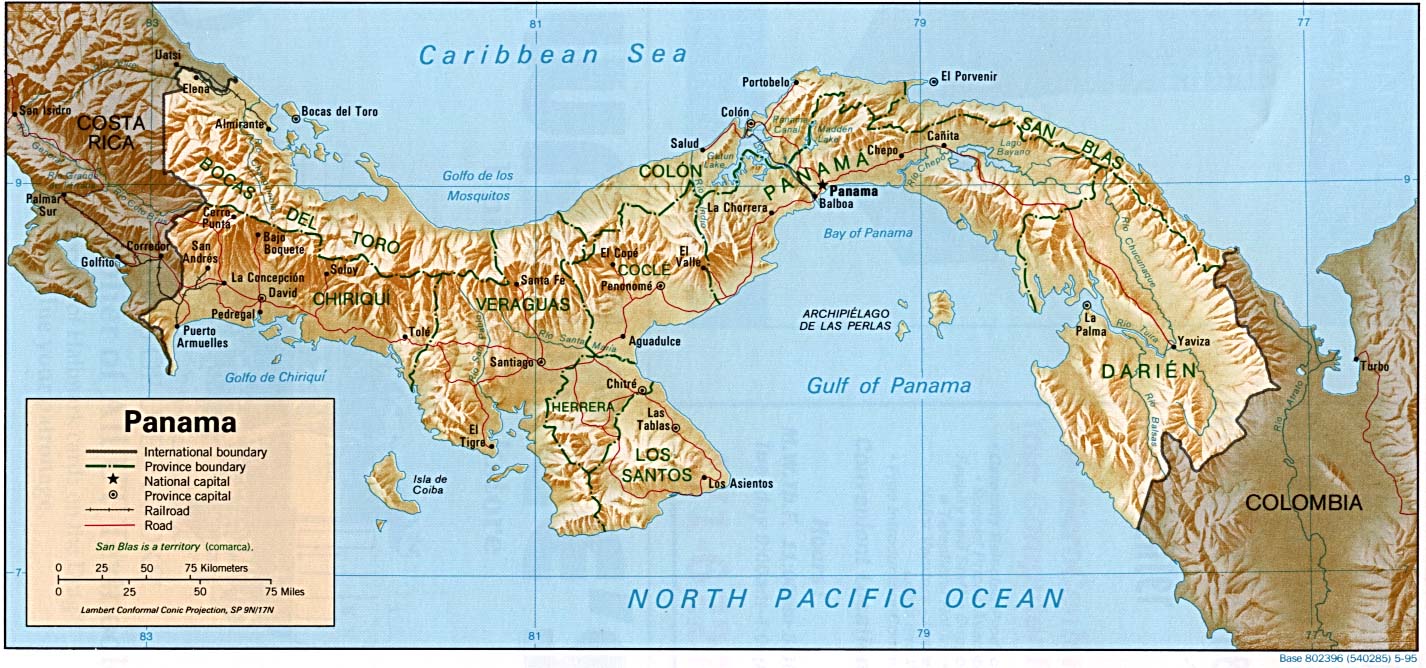

David Cameron and Tax Avoidance

David Cameron and tax avoidance A week after the Panama Papers first surfaced, the Prime Minister, David Cameron, is facing calls for his resignation. In the public imagination, David Cameron and tax avoidance are now inextricably linked and since his Government has loudly castigated such activity as morally repugnant, accusations […]

Read More

Mossack Fonseca and the journalists

Mossack Fonseca and the journalists Armed robbers with gloved hands bundle gold bars into open-zippered holdalls. An innocent security guard is beaten up by thugs and doused with petrol. Hang on, it’s before the watershed – should they be broadcasting scary scenes from gangster movies before the kids are in […]

Read More

Non-Doms: Draft legislation on the new rules on deemed domicile for tax purposes

Non-Doms: Draft legislation on the new rules on deemed domicile for tax purposes On 2 February 2016, HMRC issued the draft legislation effecting the changes to the taxation of non-doms as announced in the Summer Budget of 2015. This is the latest stage in HMRC’s consultation exercise in relation to […]

Read More

Anti-avoidance: the UK's tax legislation and EU freedoms

Anti-avoidance: the UK’s tax legislation and EU freedoms For many years now, there have been serious doubts among a number of tax advisers, myself included, about the compatibility of much of the UK’s anti-avoidance tax legislation and EU law. I remember having a conversation about 10 years ago with a […]

Read More

QNUPS, QROPS and UK Tax Planning

QNUPS, QROPS AND TAX PLANNING The number and frequency of changes in pensions legislation in the UK over the last 10 years have been staggering and QNUPS and QROPS are just a small part of that. It all began on a fateful day in 2006 designated by the Treasury and […]

Read More

Thinking of incorporating your residential lettings business?

Thinking of incorporating your residential lettings business? The recent budget changes to mortgage interest relief have focused a lot of landlords’ minds on the potential benefits of running their businesses through a limited company. Companies pay tax at much lower rates than individuals and there are no restrictions on the […]

Read More

EBTs – Where are we now?

EBTs – Where are we now? The news that the liquidators of Rangers Oldco, BDO Stay Hayward, are seeking leave to appeal the recent decision of the Court of Session regarding Rangers’ EBT to the Supreme Court does not come as a surprise. Many commentators have questioned the reasoning behind […]

Read More